What’s keeping CFOs up at night in 2020? has been saved

Perspectives

What’s keeping CFOs up at night in 2020?

CFO Insights

In this issue of CFO Insights, we focus on the many challenges that comprise the list of factors fanning CFO restlessness at a time when flux seems here to stay.

Explore content

Introduction

Let’s assume we know what’s been keeping CFOs awake for most of this year. Given the global impact of the COVID-19 pandemic, it might be more appropriate to ask: How on earth have they gotten any shut-eye since early spring?

In the pandemic’s immediate aftermath, of course, it’s doubtful finance leaders snoozed long enough to sink into a REM cycle. Forced to reconsider nearly every aspect of how they conduct business, many CFOs have spent months setting—and resetting—their priorities and expectations. In many cases, after shoring up liquidity, they also had to tap uncomfortable levers: pausing some projects, applying triage to planned investments, balancing layoffs with salary cuts and furloughs, and applying for government relief.

Many companies were also forced to not just go virtual, but to accelerate their digital journeys. And CFOs, along with IT, had to move quickly, on business and digital transformations, implementing front-and-back-office tools, and platforms to enable virtual selling and providing services remotely. In some cases, FP&A teams required upskilling so finance leaders could swiftly ramp up operational improvements in budgeting and forecasting. Meanwhile, management and boards demanded more granular data and, as much as possible, real-time visibility into key metrics, especially those related to the pandemic-induced recession.1

Now, as some companies have begun executing on return-to-work plans, CFOs are far from worry-free. In Deloitte’s latest CFO Signals™ survey, just 37 percent of respondents reported that they expect to achieve 95 percent or more of the revenue they originally budgeted for 2020. Moreover, 25 percent say they won’t reach or exceed their pre-crisis operating level until Q1 2022 or later. Among the 155 respondents, who represent many of North America’s largest and most influential companies, top concerns included new waves of infections, more shutdowns, and the possibility of a longer-term recession.2

Those insights, along with others expressed in the other activities of Deloitte’s CFO Program—including CFO Transition Labs™, CFO Forums, CFO Vision™, and the Deloitte Module of the CFO Journal—inform the following list of factors fanning CFO restlessness at a time when flux seems here to stay. Individually, each concern signifies an area that demands finance leadership; combined, they illustrate just how the pandemic has changed the day-to-day finance operations at many organizations.

CFO concerns

1. Rationalizing globalization. Supply chain disruptions, sparked by the pandemic, have led many finance leaders to cast a fresh, critical eye on the role and impact of their global ecosystem. Deloitte’s CFO Signals for Q2 2020 found that nearly 40 percent of surveyed CFOs expect their supply chains to be more diversified post-crisis.3 How significantly could options, such as “onshoring” or “nearshoring,” reduce risks and costs? As they reconfigure their supply networks to boost resilience, CFOs may decide to swap their extended supply chains for more regional versions. They may also accelerate their investment in automation, adding online risk-sensing tools to increase traceability and transparency, and illuminating the entire supply chain ecosystem. Companies that have experienced production disruptions as a result of locating factories in China and elsewhere may see the pandemic as an opportunity to de-risk and diversify.

2. Leveraging liquidity. When the pandemic first hit, liquidity and cash flow became paramount, with a number of companies scrambling to shore up debt and diversify financing sources. For companies whose sturdy balance sheets withstood the pandemic’s onset, however, now may be the time to raise debt, deploying funds to target increasingly affordable acquisitions (see “In the coming economy, M&A strategies emerging as a big deal,” CFO Insights, June 2020) in areas ripe for consolidation. CFOs may also decide to divest assets to raise capital for transformational transactions, that can catapult them over their rivals. Companies still in need of liquidity, however, may decide to continue focusing on cash flow, reducing such costs as real estate (see “Space exploration: CFO considerations for strategically evaluating real estate,” CFO Insights, July 2020).

3. Accelerating digitalization. In the Q3 2020 CFO Signals survey, CFOs’ most-cited strategic shift was toward more and longer-term remote work, but many also cited an acceleration of business digitalization. In fact, one respondent wrote that the company “had good digital capabilities, but expected to use them 10 percent of the time; now it’s 75 percent, and going-forward will probably be 50 percent.” The crisis has also served as a catalyst for the finance function to expand its own use of automation, including in the annual planning process and FP&A. As CFOs evaluate the range of new investments, they need to consider technology that not only allows for better business outcomes, but also maintains data privacy and bolsters cybersecurity measures. Moreover, as their companies develop capabilities for digitalizing familiar activities (such as investor days, board meetings, and other events), CFOs will also have to evaluate the need to invest in next-level technologies, such as AI-fueled analytics and RPA.

4. Preparing for a long-term recession. For the first time in the history of CFO Signals, which dates back to 2010, there is a larger proportion of CFOs rating China’s economy as good and expecting conditions to be better there a year from now than those expressing a similar sentiment for North America. In the most recent survey, 7 percent of CFOs rate the North American economy as good; 60 percent rate it as bad. Only 43 percent expect conditions to be better a year from now. That contrasts with the 22 percent of CFOs who rate China’s economy as good and the 47 percent expecting conditions to be better there a year from now. Still, that’s not the survey’s most discouraging news. Concerns among CFOs that the pandemic might trigger a longer-term recession also rose this quarter—and they aren’t the only ones. The World Bank predicts that the global economy will endure its deepest recession since WWII ended, with GDP contracting 5.2 percent this year.4

5. Sustaining a virtual culture. For many finance departments, the COVID-19 pandemic introduced virtual work to a function that traditionally required all hands on deck. It is turning out to be a not-so-short-term experiment (see “Remote control: How finance works, not where, matters most now,” CFO Insights, July 2020). In Q2 2020 CFO Signals, three-fourths of respondents said they expected more of their company’s workforce to work remotely in the future. And almost three-quarters (72 percent) said that they anticipated that more finance work will be conducted remotely post-crisis.

6. However, incessant connectivity can lead to creative exhaustion. CFOs need to learn how to lead a virtual group, paying special attention to the tone and inflection in their voices, speaking openly, and reinforcing desired behaviors. In fact, as hybrid cultures develop, it might be wise to convene teams to assess what worked well in the virtual environment and develop plans to maintain desired behaviors and continually refresh energies and focus. In addition, CFOs might consider capitalizing on the pivot to the virtual work environment to track any talent gaps (for example, areas that require digital skills) that became evident and then team with human resources to develop plans to mitigate those gaps.

7. Retaining talent. While talent is a perennial worry, many CFOs express heightened concerns about retaining their already-remote colleagues and preventing them from migrating to a different employer. Other financial leaders, having shown themselves capable of leading through a crisis, are in demand by boards who might find their current CFOs lacking. Respondents to the Q3 2020 CFO Signals survey ranked “retention of key talent” among their most pressing concerns. “Even with a global pandemic, the more talented, experienced, and high potential members of our teams are being recruited,” wrote one respondent. Others echoed that sentiment in listing their most worrisome risks for the rest of 2020, with replies such as “talent development and retention,” “being able to pay our best performers enough to retain them,” and “motivating and retaining top talent.”

8. Cultivating calmness. Unsurprisingly, CFOs have mainly been focused on managing costs and maintaining liquidity since the pandemic hit. But stakeholder communication, also an important aspect of their role, has taken a new direction. To drive crisis management, and help the organization make plans to re-engage customers in the post-COVID marketplace, CFOs have had to make an effort to lead, as one surveyed finance chief noted, by “being transparent and empathetic.” This economic downturn is, at heart, a health crisis. Employees need to feel safe, meaning it’s up to management to convey compassion. In the Q3 2020 CFO Signals survey, one CFO wrote that the most important role he or she has played since the pandemic has been “providing a sense of calm and perspective that the company is well positioned to manage through this cycle.”

9. Finding the outsourcing/automation balance. With demand wobbly, CFOs will inevitably look to improve efficiencies and achieve cost reduction in nonessential or repeatable processes. As a result, companies may increase their outsourcing of some activities. The Q2 2020 CFO Signals survey found that CFOs—with many having overseen their first remote quarterly close—overwhelmingly expect more automation and cloud computing; nearly one-half of respondents expect to have fewer finance staff in a year. Among respondents, 16 percent of CFOs are expecting to use more outsourced finance services. Still, as the changed duties of the finance function come into view, it will fall to CFOs to strike the right balance between outsourcing and automation, as well as to determine what new skills can be achieved through the cross-training of current staff.

10. Projecting performance. The level of uncertainty that surrounds the future of the economy will likely require CFOs to forecast and reforecast, testing different scenarios on an almost continuous basis. But questions abound: Which assumptions are most reliable—and how often should they be revisited? What risks are ascendant at any given time, and how can they be managed effectively? With such a high proportion of business performance (especially top-line revenues) influenced by external factors, how can an organization collect, sense, and manage those factors? Rather than aiming for precision, finance leaders may be better served by thinking through different options and contingencies. The result: a COVID-19 playbook that can help anticipate—and adjust to—the impact of specific changes.

11. Championing practical innovation. In addition to agility—and the likelihood that today’s assumptions may need to change tomorrow—CFOs need to lead the organization in championing new revenue streams through innovation. Just as companies have found new ways for their employees to work and interact, they may find ways to combine technology with improved data, leading to practical innovations. But companies’ best routes to matching their pre-pandemic performance may be in identifying new products and/or services, or trying different pricing strategies, channels of distribution, and markets. Even as companies make difficult financial decisions, CFOs need to know when to greenlight the options that will serve them well in the future.

There’s no surefire way for CFOs to conceive, or inspire, such innovation. It’s worth noting, however, that sometimes a good nap helps.

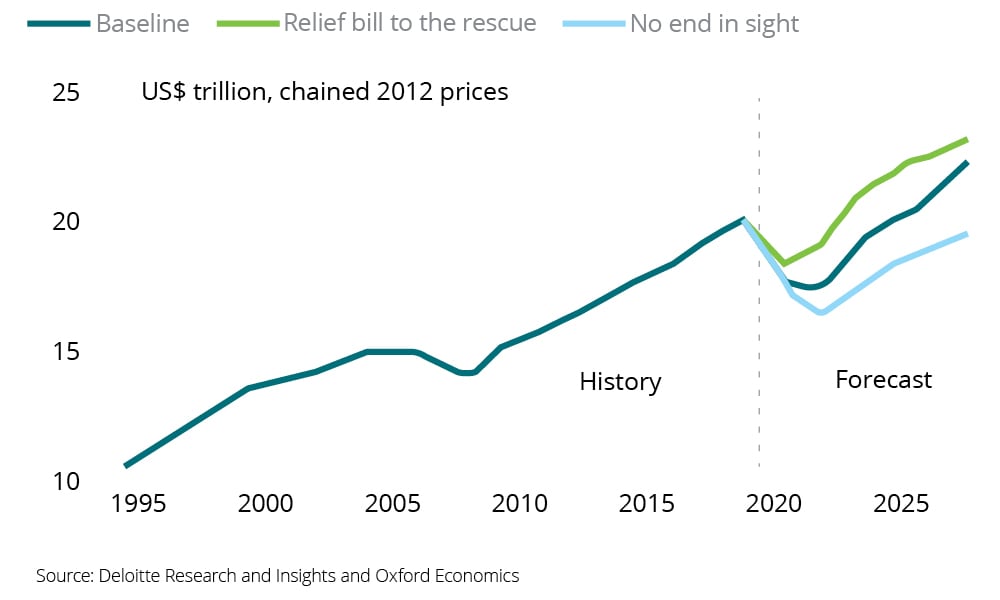

Deloitte's GDP forecast scenarios: Three dimensions

The scenarios and their probabilities are outlined in the recently published US Economic Forecast Q3 2020.

Relief bill to the rescue (20 percent)

In an eleventh hour compromise, congressional negotiations for additional relief succeed during Q3. Most of the lost personal income from the withdrawal of the $600 unemployment insurance supplement is replaced, and the federal government provides resources to state and local governments, and especially to schools. Personal spending picks up in September, and state and local spending remains steady. Schools are able to provide enough coverage to enable people to return to work, and workers in areas with virtual schools are generally successful in finding solutions to their child care problems.

In late 2020, a successful vaccine trial lifts business and consumer confidence, although restrictions remain for six to 12 months in some places as the vaccine is deployed. By late 2021, most health restrictions have been removed, and the earlier federal action to provide financing to the private sector bears fruit, as many companies are able to quickly resume operating at former levels.

Baseline (55 percent)

The lack of a fourth relief package has a significant impact on US GDP. Both consumer spending and state and local government spending fall substantially beginning in August. Overall demand falls and, later in the year, is at best flat. Schools turning to virtual learning pulls potential workers (especially women) out of the labor force, so the unemployment rate spikes less than expected. However, the economy remains very weak until deployment of a vaccine in early 2021 creates conditions for improvement. Since deployment takes time, the economy does not see significant growth until the middle of 2021. Growth then picks up speed, although potential growth remains lower than the pre-pandemic level.

No end in sight (25 percent)

COVID-19 cases remain high for the rest of this year, and states are forced to attempt to again limit economic activity. Schools meet virtually, and some parents leave the labor force to manage their children’s schooling. The lack of either treatment or an effective vaccine means that the cycle of restart attempts and subsequent reclosing continues. This limits the possibility of recovery and erodes trust in institutions; even as treatment improves and businesses again reopen, consumers prefer to stay at home in safety rather than take what they have come to believe are unwarranted risks. One quarter of faster growth, in Q3 2020, is offset by a decline in Q4 2020 due to fresh outbreaks in the fall and the lack of policy response. After that, the recovery is hesitant and GDP growth remains relatively slow. By 2025, unemployment remains in double digits, with the level of GDP more than 10 percent below the level it would have reached had the pandemic not occurred.

Endnotes

1 “Reinventing FP&A for the pandemic and beyond,” CFO Insights, Deloitte LLC, August 2020.

2 CFO Signals, Q3 2020, CFO Program, Deloitte LLP.

3 CFO Signals, Q2 2020, CFO Program, Deloitte LLP.

4 “The Global Economic Outlook During the COVID-19 Pandemic: A Changed World,” The World Bank, June 8, 2020.

Contact us

Daniel Bachman |

Patricia Buckley |

Greg Dickinson |

Steve Gallucci |

Dean Hobbs |

Ajit Kambil |

Eric Merrill |

Matt Soderberg |

CFO Insights, a biweekly thought leadership series, provides an easily digestible and regular stream of perspectives on the challenges you are confronted with.

View the CFO Insights library.

About Deloitte's CFO Program

The CFO Program brings together a multidisciplinary team of Deloitte leaders and subject-matter specialists to help CFOs stay ahead in the face of growing challenges and demands. The Program harnesses our organization’s broad capabilities to deliver forward-thinking and fresh insights for every stage of a CFO’s career—helping CFOs manage the complexities of their roles, tackle their company’s most compelling challenges, and adapt to strategic shifts in the market.

Learn more about Deloitte’s CFO Program.