Life sciences transformation powered by external innovation has been saved

Perspectives

Life sciences transformation powered by external innovation

Using technology acquisitions to thrive in a time of convergence and disruption

As the volume and strategic importance of innovative technology acquisitions by life sciences companies continue to rise, corporate leaders need to determine the best strategies for integrating these smaller technology- and capability-focused companies.

Small technology acquisitions in life sciences

Small tech acquisitions in life sciences have become more prominent as technological innovation outside the lab and clinic are becoming a competitive advantage. For example, many life sciences companies are considering the use of artificial intelligence to augment research and development, digital biomarkers to validate clinical efficacy, and virtual patient engagement tools as foundations for patient-centered health care delivery.1

Consequently, many business leaders are eagerly searching for ways to turn this new environment from a cause for concern to a way to reshape their business model. In fact, in a survey of strategic drivers, a cross-industry panel of senior executives cited technology acquisitions as the most important.2

In response, companies are increasingly acquiring small technology companies to obtain the technological experience, talent, and products needed to harness the potential in the high-growth corners of the industry. Globally, buyers from different industries spent around $877 billion from 2015–2018 on advanced technology and cross-capability deals; one-third of these deals fell in the $50 million–$1 billion range.3 Hence, mergers and acquisitions (M&A) and alternative deal structures (such as strategic alliances and ecosystem investments) can provide a fast track for life sciences companies to drive growth, create value, and disrupt the market.

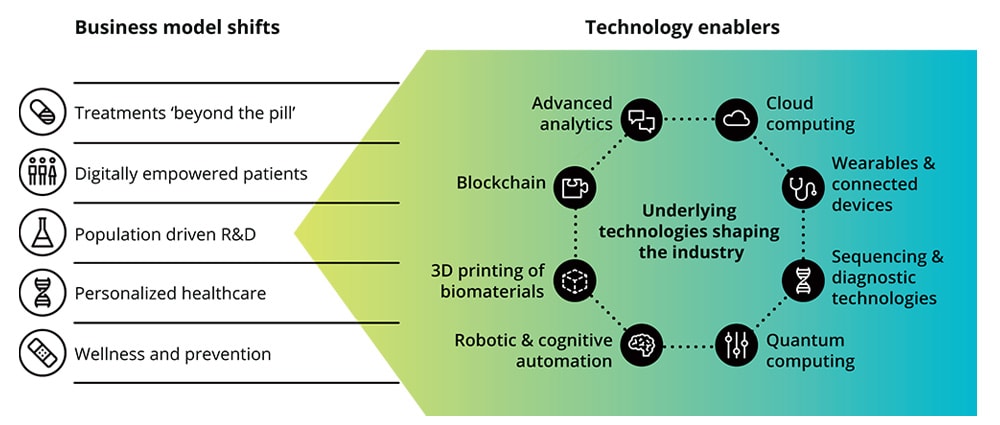

Business model shifts, along with life sciences and health care technological innovation, driving small deal activity.

When executing these small entrepreneurial technology deals, even companies with historically strong M&A experience can face novel and unprecedented challenges. From the initial deal strategy through integration, unique strategic, operational, human capital, and technology stumbling blocks can hinder performance and reduce the deal’s return on investment. Through our experience, Deloitte has observed several recurring patterns across deal integration strategies that can be useful for M&A leaders when exploring integration strategies.

Integration strategies for small technology acquisitions

When considering recent market deal activity and trends, the revenue stage of the target and degree of alignment between the buyer’s and target’s businesses appear to be the most prominent factors influencing the chosen integration strategy. Integration strategies and challenges associated with these strategies include:

Targets whose offering is close to the acquirer’s core business while being at an earlier revenue stage have most commonly been integrated following a “tuck-in” strategy, where the target is fully integrated within the buyer’s existing operations and business unit. These are typically deals that focus on a very specific technological advancement that complements the buyer’s product offering—breakthrough technology acquisitions.

For example, Illumina, a biotech company in the genetic sequencing market, acquired Edico Genome, a novel bio-informatic startup, to leverage its proprietary hardware and software algorithms to reduce both data footprint and time to results of Illumina’s sequencing offering. The technology was fully integrated in the product offering.4, 5

Tuck-ins of small technology organizations have unique challenges. Foremost, fully integrating the nimble target organization into a much larger, bureaucratic, and political buyer organization tends to subsume the culture that ultimately allowed the target to build its value proposition. In turn, this may harm the nimbleness that’s required to achieve the entire deal thesis.

Many would rightfully argue that the bigger talent challenge is managing retention. Why, for example, should a founder who thrives on entrepreneurship stay in an organization with much more structure? Retaining the founder in the near term is critical as they often have significant followership—why would leadership and staff stay without the visionary leader that brought them to where they are today?

As a mitigation, some buyers have made sure the founder (and critical talent) is coached by executive mentors, providing guidance on how to grow and succeed in the buyer organization. Alternatively, founders (and critical talent) are often given milestone-based incentive packages to stay on, similar to the incentive plans of a private equity buyout.

When the target has an established revenue stream and the products are core to that of the buyer organization, consolidation of the target and buyer has been a common integration strategy—harmonizing operations into a restructured business unit. These deals are often technology portfolio acquisitions. For example, Quidel, a provider of diagnostic testing solutions, acquired Alere Triage, a provider of cardiovascular point-of-care (POC) diagnostics, to diversify its business by seasonality and geography, while strengthening its position in the POC market4—consolidating Alere Triage’s portfolio into Quidel’s operations.

As these deals have a different strategic rationale, they have challenges that are different from tuck-ins. First, there’s often a (cost and/or revenue) synergy component that’s critical to the deal value. If synergy capture incentives aren’t established across the target and buyer organization before close, value leakage becomes a common issue.

Furthermore, integration activities tend to hamper the target’s operations (in terms of efficiency and morale), as the target organization typically doesn’t have spare capacity to manage the integration in addition to its daily operations; individual employees at the target organization often have responsibilities that span multiple roles within the buyer organization.

To address this, companies should prioritize integration activities, focusing on markets or development programs most vital to delivering deal value. Phasing the integration can reduce the impact on the target and minimize business disruption for life sciences companies.

When the target company focuses on products and markets outside the buyer’s core operations and has existing revenue streams, a transformation integration strategy is often pursued—overhauling the combined buyer/target organization by establishing a new business unit or entity. These kinds of integrations are often acquisitions where the acquirer is looking to enter a new market. For example, when ResMed, a global leader in connected health care solutions, acquired Brightree, a software solution developer for the post–acute care industry, it augmented and expanded Brightree’s offering with capabilities to connect to ResMed’s products—transforming the combined ResMed/Brightree portfolio and operations.6

By definition, these integrations are more disruptive to the organization, restructuring the combined entity’s efforts and operations to achieve the goals and benefits laid out in the deal thesis. To be able to establish the deal thesis, among the first challenges when considering a transformation is identifying the “secret sauce”—the capability, cultural archetypes, people, or IP that are core to the deal value—and striving to ensure this is retained while transforming the business. Second, a common pitfall is losing the acquired technology in the shuffle—starving it from the requisite attention, investment, and resourcing of management.

In response to these challenges, consider establishing scenario models that help identify the components critical to the success of the deal and to generating material incremental value. To avoid losing the “secret sauce,” one potential approach for deal sponsors to consider is ring-fencing the technology and people in the near term, helping ensure sufficient resources and attention are provided.

When the target company focuses on products and markets outside the buyer’s core operations and doesn’t yet have a revenue stream, a bolt-on integration strategy is often pursued—keeping the target organization at arm’s length as a separate business entity. These are often acquisitions where the acquirer is looking to establish an innovation hub for product development. For example, Life Technologies, a leading DNA sequencing platform company, acquired Ion Torrent, a startup developing an alternative sequencing platform, to establish a foothold in next-gen technology to compete with the market leader—keeping the target as an independent scientific and development entity.7

This integration strategy is most different from the others and may be considered “value destroying” in certain scenarios. One of the most significant challenges for a bolt-on integration strategy is therefore identifying how the buyer can deliver incremental value while keeping the business stand-alone. In turn, the buyer will need to find the right level of support to provide for corporate coordination and establish ways to effectively work together with the target—creating knowledge-sharing opportunities for both target and buyer employees.

Similar to tuck-in acquisitions, many companies use milestone-based incentive structures to maintain momentum and realize deal value. In addition, companies should consider placing significant focus on understanding talent needs from a workplace, culture, and total rewards perspective to help ensure the target’s employees truly feel they can maintain their identity.

A summary of the most common and critical challenges, as well as leading practices, can be found in the PDF version of the paper.

Choosing the right integration strategy

We appreciate that there is no one-size-fits-all strategy for any acquisition, let alone the diverse set of small technology acquisitions that life sciences companies are undertaking. What is clear is that these acquisitions require unique integration strategies and approaches, different from what many experienced M&A and corporate development teams may be used to. Deloitte previously published perspectives outlining several challenges and leading practices related to small technology acquisitions, including:

- Deloitte, “Preserving the secret sauce of a tech startup through integration,” 2019.

- Deloitte, “Acquiring for growth: Small integrations, big challenges,” 2018.

- Deloitte, “Cyber risk in M&A due diligence,” CIO Journal for Wall Street Journal, 2017.

For life sciences companies planning or actively pursuing small technology transactions, they should consider posing the following questions early in the deal life cycle:

- What additional due diligence topics do we need to consider when evaluating a small technology target? Do we need to adjust our due diligence approach?

- What does the buyer’s experience demonstrate? What are our reference points for the success or lack thereof for various approaches?

- How do we identify, prioritize, and amplify the value drivers? Do they receive equal weight for

integration planning? - What is realistic for retention? And how do we price in the cost of retention and the cost of turnover?

- What variations from our standards are acceptable for integration (e.g., policies, processes, systems)?

Endnotes

1 Sriram Prakash and Haranath Sriyapureddy, “The beginning of a new M&A season: Future of the deal,” Deloitte, 2018.

2 Deloitte, “2019 Global life sciences outlook: Focus and transform | Accelerating change in life sciences,” 2019

3 Deloitte, “The state of the deal: M&A trends 2019,” 2018

4 “Illumina [press release], “Illumina acquires Edico Genome to accelerate genomic data analysis,” May 15, 2018.

5 Bio-IT World, “Illumina announces acquisition of Edico Genome,” May 16, 2018.

6 ResMed [press release], “ResMed to acquire Brightree for $800 million,” February 22, 2016.

7 BusinessWire,“Life Technologies announces agreement to acquire Ion Torrent,” August 17, 2010.

Recommendations

Small gains, big wins

Disruptive M&A: Creating value through innovation-led acquisitions

2020 US and global life sciences outlook

Creating new value: Building blocks for the future