How to execute annual financial planning and forecasting in today’s environment has been saved

Perspectives

How to execute annual financial planning and forecasting in today’s environment

Strategies for companies, CFOs, and planning leaders

Never has the process of prediction been so crucial. In response, CFOs and FP&A leaders should look to take action to mitigate uncertainty during the current cycle while enhancing processes over time to develop more dynamic, effective financial planning and forecasting capabilities.

Planning and forecasting processes face new challenges

The times we are living in are historic and unprecedented. Without historical business context to provide guidance, the challenge of predicting future market and consumer behavior is exacerbated.

At any time, planning and forecasting are complex efforts. With the heightened uncertainty of the current world, organizations are facing additional challenges in their planning and forecasting processes:

- Constant scenario development and modeling

- Discomfort and lack of confidence in future projections

- Urgent need for decisions and courses of action

- Unclear decision-making framework and ambiguous criteria or triggers for contingencies

- Excessive and resource-consuming manual iteration

What should CFOs and planning leaders consider when conducting crucial forward-looking financial processes? Keep reading or download the PDF.

Strategies for developing more dynamic, effective planning and forecasting capabilities

The following strategies can help produce more effective, useful near-term plan and forecast results while creating more dynamic go-forward planning and forecasting processes as well.

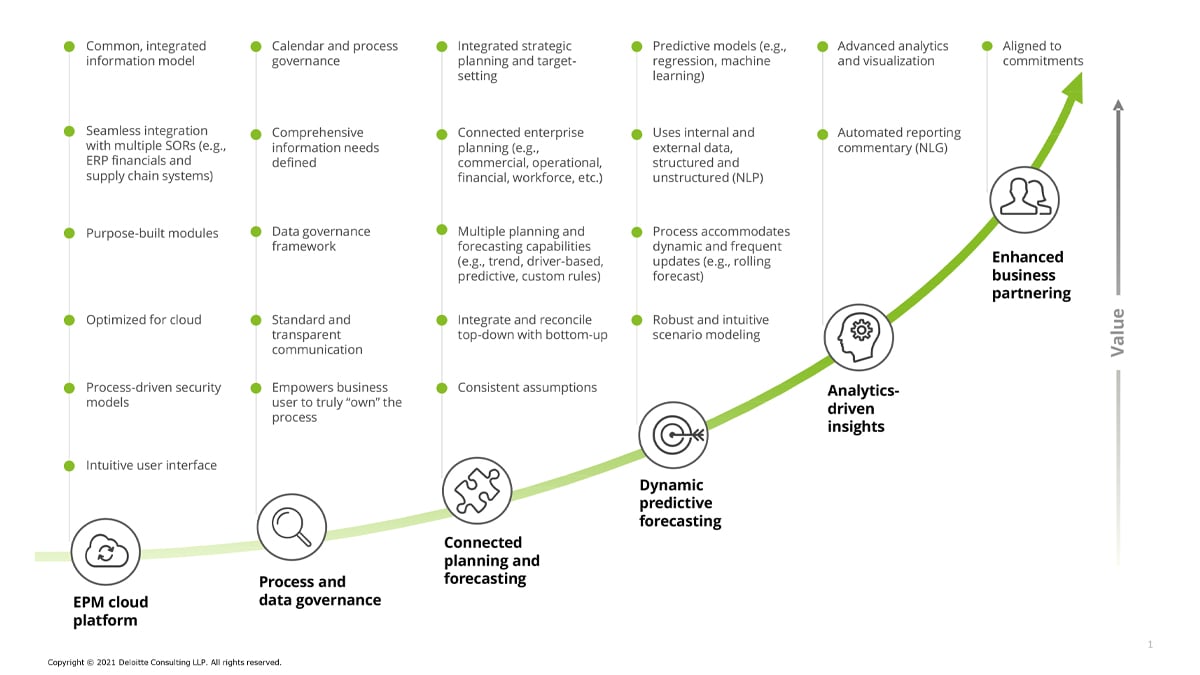

Organizations should review their current enterprise performance management (EPM) infrastructure and associated capabilities to make sure they have the building blocks in place to maximize the value that Finance can deliver through enhanced business partnership. Using a framework like the one below can help contextualize EPM maturity and target initiatives to move up the curve and deliver greater value.

Click image to enlarge

Leading-practice organizations often begin the planning process by setting strategic guidance, translating the guidance to targets, and disseminating those targets to business units. In practice, the critical challenge often comes during that latter stage, when more aspirational goals of leadership come face-to-face with more realistic expectations of performance held with the business.

To counter this, organizations can use updated forecast results to aid strategic reviews and target-setting activities. Provided that steps are taken to remove bias from recurring forecast processes, longer-horizon forecasts can provide valuable insight into expected performance to inform strategic planning and may also be used to seed annual plans and provide a baseline for target-setting activities.

Many organizations conduct planning by having business units submit a select number of targeted scenarios (for example, high, medium, and low) before identifying the most likely scenario and finalizing a single set of financial results. Rather than trying to arrive at a single number, organizations should consider identifying a range of possible outcomes. Leading-practice organizations will use observed volatility to bolster ranges with assigned probabilities, allowing leadership to plan for a wide variety of outcomes while considering the likelihood of occurrence.

Additionally, factoring in multiple modeling approaches across statistical, driver-based, optimization, and trigger-based contingency models can help an organization be prepared to understand and project impacts across multiple levels of performance outcomes. Machine-enabled modeling capabilities can evaluate thousands of possibilities in real time from a broad array of possible driver values and assumptions, removing the practical barriers that once limited finance to modeling only a select number of key scenarios. Rather than high, medium, and low, a more comprehensive, probabilistic distribution of expected outcomes allows leaders and decision-makers to assess the likelihood of any number of scenarios.

Leading-practice organizations use driver-based logic to tie financial outcomes more closely to underlying economic and organizational drivers. In times of increased volatility and divergence from historical precedent, driver-based plans have an inherent advantage over their simpler, trend-based counterparts. While trending may have been sufficient in the past, historical results may no longer be a reliable indicator of future performance in today’s volatile economy.

Organizations should look to expand driver logic, as appropriate, throughout the planning process and rely on input from those in the organization who are closest to each respective driver when establishing scenarios and plan ranges. (Note: This does not mean organizations should try to make every plan item driver-based. Materiality should always be considered; if a line item makes up less than 2% of the total plan, even a 200% actual-to-plan variance may not move the needle.)

An increased reliance on external economic drivers should also be considered during periods when activity is heavily influenced by market forces or economic shocks. For example, setting GDP as an external driver, and given an observed 10% decline in GDP, a company can expect the top line to fall within a specific range. As GDP shifts throughout the year, forecasts can be adjusted based on actuals to validate the predicted ranges. Now more than ever, plan and forecast results will be as dependent on external economic drivers as internal ones.

Additional approaches to consider can include exploring more logarithmic or exponential trending curves, as well as approaches that bias a moving or weighted average for recency. Modeling based on historic and comparable events can also prove valuable in these instances, even if the macroeconomic event itself may seem unprecedented. Machine-enabled modeling can also offer the capability to automate the process of discovery and ongoing driver evaluation with the ability to update, adjust, and continuously improve performance as new information becomes available.

Many organizations are reconsidering the areas and depths to which they plan and forecast financial results. They are also thinking about the timing of their plan and forecast cycles (for example, delaying plan kick-off to incorporate more recent actuals and updated forecast data). Given this context, there is an opportunity for organizations to evaluate what activities truly add value to streamline and refocus efforts traditionally spent on the iterative planning process to realize a more sustainable, agile approach.

Acceleration of digital capabilities can also play a significant role in easing the burden of target-setting, scenario analysis, iteration, and any required resetting of the baseline, particularly when technologies that can help ingest new data and drivers, and score their relevance automatically, are deployed as part of the planning and forecasting capabilities.

Additional planning and forecasting considerations

Organizations should carry these practices forward and layer in the following to help build planning and forecasting processes that are more robust, flexible, and shock-resistant.

Realize the power of a dynamic, predictive forecast: Many organizations perform a quarterly forecast (if they execute a forecast at all). Now, the days of only executing a forecast quarterly are being challenged. Executives are increasingly expecting a forward-looking view of the financials updated on a monthly, if not on-demand, basis to adjust projections, incorporate new scenarios, and inform strategic decisions. Organizations should consider forecasting key line items, and underlying drivers, on a monthly basis, including topline drivers, revenue growth, and operating profit. Given changing market conditions, identifying core drivers and metrics by which organizations evaluate forecast-to-actuals variance monthly may prove to be a more valuable exercise for the organization than executing a detailed plan. Given the greater frequency, it is critical for organizations to revisit information needs to produce only what is relevant to steer the business and guide decision-making while leveraging technology improvements to automate and simplify processes. |

Develop connected, enterprisewide planning and forecasting capabilities: More and more organizations today are realizing the potential value of connecting functional planning and forecasting efforts throughout the organization. The value of strategic decision-making informed by financial forecasts is only increased, as those forecasts are able to seamlessly integrate expectations of future performance across the organization, including commercial and operational functions. Increasingly, enterprise-level planning and forecasting platforms are designed specifically to facilitate cross-functional integration and eliminate organizational barriers. |

Consider the impact that changes to the financial planning process will have on incentive compensation planning: Implementing the strategies above may have implications for how compensation will be tied to actual versus plan performance—a practice common across many organizations. As changes to the strategic planning and financial planning and forecasting process are identified, it will be crucial for these changes to flow through to planning and executing incentive compensation as well. |

Building a resilient financial planning and forecasting process

To successfully deliver, finance organizations should challenge the existing mechanisms by which they are executing their planning and forecasting processes and developing associated scenarios. Targeted efforts using these short- and long-term strategies can bolster planning capabilities across times of crisis, recovery, and business as usual and unlock the value that is uniquely attributable to financial forecasting and its ability to inform and strengthen strategic decision-making.

Explore our primer on algorithmic forecasting, Forecasting in a digital world, and our considerations for reinventing FP&A for an unpredictable future.

Building trust in a dynamic, predictive forecast

Predictive forecasting (using algorithms and statistical modeling techniques to describe what’s likely to happen in the future) is quickly transitioning from a “nice-to-have” productivity advantage to a foundational finance capability. Deloitte’s own PrecisionView™ solution combines data science, machine learning, and advanced visualization to help companies accelerate their forecasting and scenario modeling efforts to more quickly move to action. Still, realizing the benefit of predictive forecasting goes beyond securing organizational investment in technology capabilities. It is critical that organizations adopt a human-centered approach to integrating predictive capabilities into redesigned forecasting processes to ensure that machine-enabled capabilities align with target forecast outputs, reduce manual effort, and enable users to translate data science–driven outputs into meaningful, transparent insights.

Get in touch

To further explore what it'll look like to take your planning and forecasting capabilities to the next level, contact us:

| Raj Chhabra Managing Director Deloitte Consulting LLP |

Eric Merrill Managing Director Deloitte Consulting LLP |

| Gina Vargas Senior Manager Deloitte Consulting LLP |

JoAnna Scullin Senior Manager Deloitte Consulting LLP |

| Nic Barnett Senior Consultant Deloitte Consulting LLP |

Torchy Adams Manager Deloitte Consulting LLP |

Recommendations

PrecisionView™ Advanced Forecasting and Modeling

Accelerated visibility, amplified confidence

Algorithmic forecasting in a digital world

Improving the forecasting process with predictive analytics