Economic factors affecting lease accounting & reporting has been saved

Perspectives

Economic factors affecting lease accounting & reporting

On the Radar: A roadmap for ASC 842

Several economic factors have affected the lease accounting for many commercial real estate entities, including owners, operators, and developers. Explore hot topics, common pitfalls, and more information related to why entities that have adopted ASC 842 should continually monitor, evaluate, and update their lease-related accounting and reporting.

On the Radar series

High-level summaries of emerging issues and trends related to the accounting and financial reporting topics addressed in our Roadmap series, bringing the latest developments into focus.

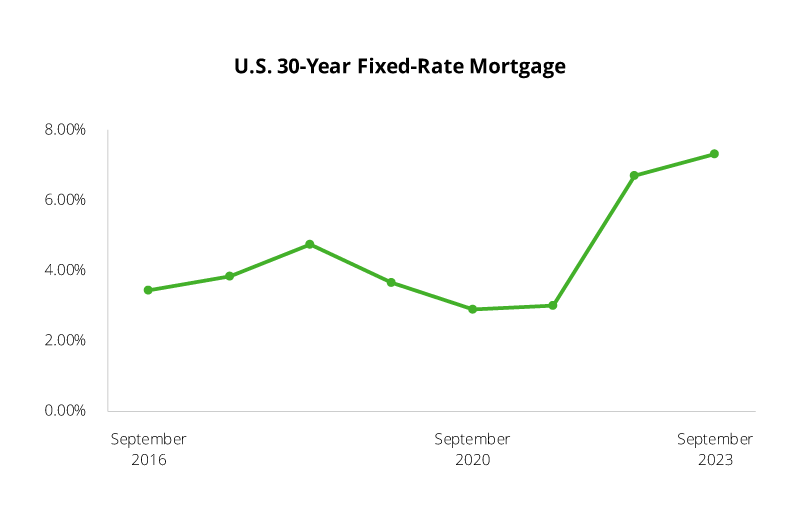

The current macroeconomic environment has created ongoing challenges and uncertainty in various areas ofaccounting, including the accounting for leases. For example, the U.S. 30-year fixed mortgage rate has nearlydoubled since 2016, the year in which ASC 842 was issued.

Source for graphic: Mortgage Rates — Freddie Mac.

Many commercial real estate entities have encountered increased costs of capital and tightening lending standards while also dealing with higher levels of maturing debt; reductions in the volume of real estate transactions; and evolving real estate demands and preferences related to the way people work, live, and shop. The actual impact of the current macroeconomic environment on commercial real estate assets will differ on the basis of various factors, including geographic location, tenant-specific operations, and in-place lease terms. Commercial real estate entities, including real estate owners, operators, and developers, should continually monitor, evaluate, and update their lease-related accounting and reporting.

Lease accounting hot topics for entities that have adopted ASC 842

The COVID-19 pandemic ignited a shift in how entities in almost every industry sector are doing business. Many entities are reevaluating where their employees conduct their required business activities and to what extent they will rely on the use of brick-and-mortar real estate assets on a go-forward basis. Specifically, many entities have initiated a real estate rationalization program to reevaluate their organization-wide real estate footprint. The goal of initiating such programs may be for entities to rightsize their real estate portfolios to manage costs while adequately supporting their evolving business needs. In addition to the macroeconomic challenges and uncertainty mentioned above, expectations related to hybrid-work approaches have led to increased vacancy rates for office properties in certain locales.

We have also observed an increase in entities abandoning properties, subleasing space they are no longer using, or modifying existing leases to change the amount of space or the lease term. Further, as a financing method to improve their liquidity, entities are increasingly entering into sale-and-leaseback transactions involving real estate. As a result of these real estate rationalization efforts, companies are also more frequently evaluating leases for impairment. Each of these topics is addressed below and within this publication. Note that the accounting considerations below apply to entities that have already adopted ASC 842.

See Deloitte’s March 30, 2021, Accounting Spotlight and May 22, 2023, Financial Reporting Alert for further details on the impact of real estate rationalization and commercial real estate macroeconomic trends, respectively, on an entity’s lease accounting.

The right-of-use (ROU) assets recorded on a lessee’s balance sheet under ASC 842 are subject to the ASC 360-10 impairment guidance applicable to long-lived assets. When events or changes in circumstances indicate that the carrying amount of the asset group may not be recoverable (i.e., impairment indicators exist), the asset group should be tested to determine whether an impairment exists. The decision to change the use of a property subject to a lease could be an impairment indicator.

Although the existence of an impairment indicator would not itself be a reason for a lessee to reevaluate the lease term for accounting purposes, an entity should consider whether any of the reassessment events in ASC 842-10-35-1 have occurred simultaneously with the impairment indicator.

The guidance in ASC 360-10 on accounting for abandoned long-lived assets also applies to ROU assets. In the context of a real estate lease, when a lessee decides that it will no longer need a property to support its business requirements but still has a contractual obligation under the underlying lease, the lessee needs to evaluate whether the ROU asset has been or will be abandoned. Abandonment accounting only applies when the underlying property subject to a lease is no longer used for any business purposes, including storage. If the lessee intends to use the space at a future time or retains the intent and ability to sublease the property, abandonment accounting would be inappropriate.

We have seen some companies assert that they are abandoning the property, even though it is only temporarily idled, or that they may still be using it for minor operational needs or may have the intent and ability to sublease it. Under these circumstances, abandonment accounting would not be appropriate. An entity may need to use significant judgment in evaluating whether abandonment has occurred, and a high bar has been set for concluding that a property has been abandoned.

In our experience, establishing management’s intent regarding subleasing involves judgment and depends on various facts and circumstances, such as the remaining lease term, the nature of the property, and the level of demand in the rental market. For example, it may be reasonable to conclude that an ROU asset is subject to abandonment accounting when the remaining lease term is shorter and the rental market is, and is expected to remain, weak. On the other hand, it may be more challenging to conclude that management has forgone the opportunity to sublease the property if the remaining lease term is longer, given the increased uncertainty about the level of demand in the rental market over a longer time horizon. It may be particularly difficult to reach such a conclusion in the current environment given the uncertainties related to the duration of the COVID-19 pandemic and its impact on the real estate strategy of other market participants going forward. There are no bright lines regarding the duration of the remaining lease term in this analysis, and the exercise could differ from one rental market to the next. We would also expect specialized properties to be more difficult to sublease than more generic properties such as retail shopping units and office space. Entities should carefully evaluate their specific facts and circumstances when determining whether the ASC 360 abandonment accounting applies to the ROU asset.

A lessee may enter into a sublease if the lessee no longer wants to use the underlying asset but has identified a third party to which the asset will be leased. In a sublease, the original lease between the lessor and the original lessee (i.e., the head lease) typically remains in effect and the original lessee becomes the intermediate lessor. Generally, the lessee/intermediate lessor should account for the head lease and the sublease as separate contracts and should consider whether the sublease changes the lease term of the head lease or its classification. The head lessor’s accounting is unaffected by the existence of the sublease.

In the current environment, tenants may negotiate with lessors to exit early from a leased space, decrease the amount of leased space, or terminate the lease in its entirety. Some lessees are modifying existing lease agreements by (1) eliminating or scaling back office space as a result of hybrid models in a post-pandemic working environment and (2) reducing space because of changes in the current environment to cut or maintain costs. The accounting for a lease modification under ASC 842 depends on whether the modification is accounted for as a separate contract as well as the nature of the modification.

Many amended contracts describe a lease amendment as an early termination. In evaluating these types of amendments, a lessee must determine whether the amendment is actually a modification to reduce the lease term. If a termination takes effect after a specified period (even a relatively short period), the lessee still has the right to use the leased asset for that period. In such cases, the modification consists of a reduction in the lease term rather than a full or partial termination. The guidance on full or partial terminations only applies when all or part of the lessee’s right of use ceases contemporaneously with the execution of the modification (i.e., the space is immediately vacated). As a reminder, an immediate charge to the income statement is only appropriate when the lease is fully or partially terminated

Evaluation of Lease Options

When determining the lease term at lease commencement, an entity should determine the noncancelable period of a lease, which includes lessee renewal option periods whose exercise is believed to be reasonably certain (and includes lessee termination option periods when exercise is reasonably certain not to occur). The likelihood of whether a lessee will be economically compelled to exercise or not exercise an option to renew or terminate a lease is evaluated at lease commencement. In performing this assessment, an entity would consider contract-based, asset-based, entity-based, and market-based factors (e.g., the market rental rates for comparable assets), which may be affected by changes in the macroeconomic environment. A lessor would not reassess the lease term unless the lease is modified and the modification is not accounted for as a separate contract.

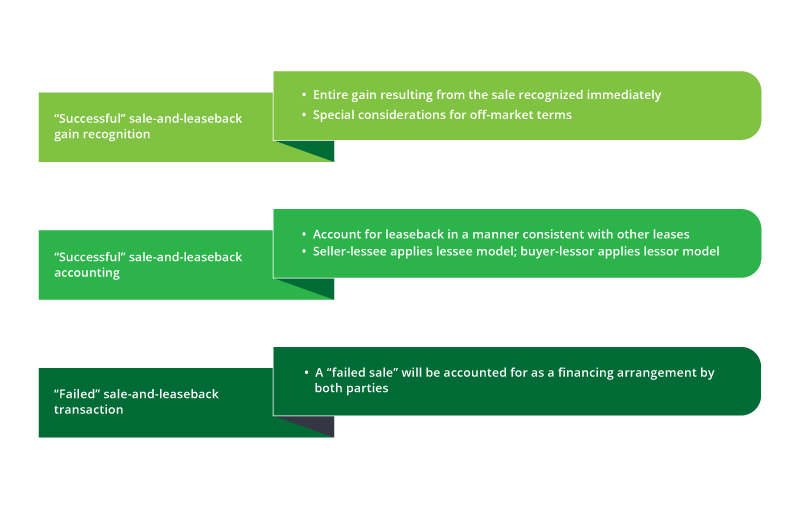

A sale-and-leaseback transaction is a common and important financing method for many entities and involves the transfer of a property by the owner (“seller-lessee”) to an acquirer (“buyer-lessor”) and a transfer of the right to control the use of that same asset back to the seller-lessee for a certain period.

It is important for an entity to evaluate the provisions of any sale-and-leaseback arrangement since the contract terms may significantly affect the accounting. For example, the seller-lessee would not be able to derecognize the underlying asset (i.e., a failed sale) or recognize any associated gain or loss on the sale if (1) the contract includes a provision that grants the original owner (future tenant) an option to repurchase the property or (2) the leaseback would be classified as a finance lease. Rather, both parties would account for the transaction as a financing arrangement. The below graphic outlines key considerations related to the accounting for a sale-and-leaseback arrangement.

In addition to the impairment considerations described above, lessors should be aware that net investments in leases (arising from sales-type and direct financing leases) are subject to the CECL impairment model, which is based on expected losses rather than historical incurred losses. See Section 5.3 of Deloitte’s Roadmap Current Expected Credit Losses for further discussion of the application of the CECL model to lease receivables. Lessors with outstanding operating lease receivables must apply the collectibility model under ASC 842-30. Entities should apply this collectibility model in a timely manner in the period in which amounts under the lease agreement are due. Under the ASC 842-30 collectibility model, an entity continually evaluates whether it is probable that future operating lease payments will be collected on the basis of the individual lessee’s credit risk. When collectibility of the lease payments is probable, the lessor will apply an accrual method of accounting. When collectibility is not probable, the lessor will limit lease income to the cash received, as described in ASC 842-30-25-13. Entities should continue to assess the impact of the current environment when determining whether to move tenants either to or from this cash basis of accounting as opposed to the accrual method of accounting.

Ongoing accounting standard-setting activities

Since the issuance of ASU 2016-02 several years ago, the FASB has released various ASUs to provide additional transition relief and make certain technical corrections and improvements to the standard.

Most recently, in March 2023, the FASB issued ASU 2023-01, which amends certain provisions of ASC 842 that apply to arrangements between related parties under common control. ASU 2023-01 allows non-PBEs, as well as not-for-profit entities that are not conduit bond obligors, to make an accounting policy election of using the written terms and conditions of a common-control arrangement when determining whether a lease exists, as well as the accounting for the lease (including lease classification), on an arrangement-by-arrangement basis. Accordingly, a non-PBE, as well as a not-for-profit entity that is not a conduit bond obligor, that makes this election may not be required to consider the legal enforceability of such written terms and conditions, as described above.

ASU 2023-01 also amends the accounting for leasehold improvements in common-control arrangements for all entities.

The FASB continues to evaluate stakeholder feedback on the adoption of ASC 842. Stay tuned for future refinements in accounting standard setting as a result of these initiatives.

Learn more about lease accounting

ASC 842 offers practical expedients that can be elected by certain entities or in certain arrangements. For a comprehensive discussion of the lease accounting guidance in ASC 842, see Deloitte's Roadmap Leases.

Lease Accounting focus areas—watch the videos

Subscribe to the Deloitte Roadmap Series

The Roadmap series provides comprehensive, easy-to-understand guides on applying FASB and SEC accounting and financial reporting requirements.

Explore the Roadmap library in the Deloitte Accounting Research Tool (DART), and subscribe to receive new publications via email.

Let's talk!

Recommendations

Operationalizing the new lease standard

Lease accounting

New lease standard implementation workshop

Understanding and implementing FASB ASC 842