Crunch time series for CFOs: Lights Out Finance™ has been saved

Perspectives

Crunch time series for CFOs: Lights Out Finance™

New horizons for a future-forward finance function

Crunch time series for CFOs:

Lights Out Finance™

New horizons for a future-forward finance function

Lights Out Finance™ is about working smarter. It’s time to take a lights out approach to your back-office finance operations with touchless processes and intelligent automation. You might even be surprised to learn that you have many of the resources to become truly digital—it’s just a matter of fine-tuning the dials. Ready to flip the switch?

Turning the lights out on corporate finance back-office management

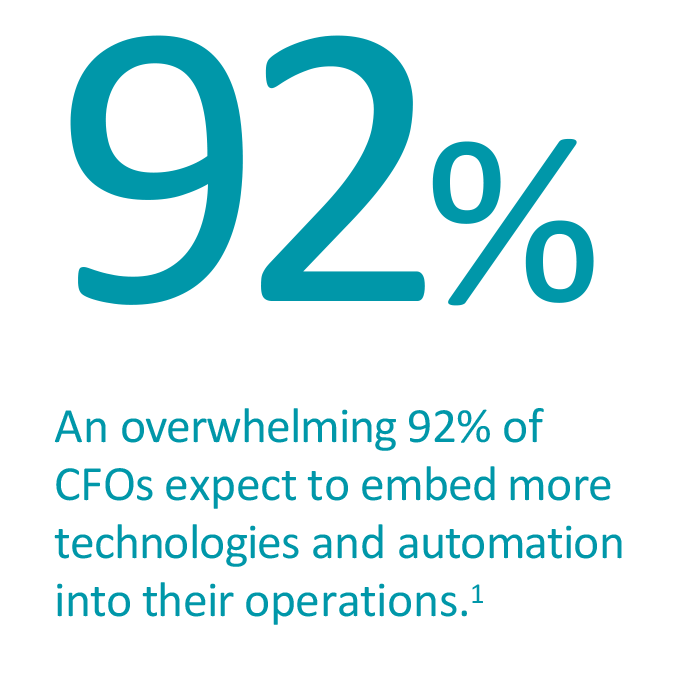

As pressures increase on Finance to perform, one thing is clear: Disruption isn’t going away—and neither will the pressures. Leaders are right to wonder how intelligent automation will truly streamline processes, get the best out of their talent, and partner at higher levels across the organization, all while getting the books closed on time.

We have an idea: It’s Lights Out Finance™, a principle of Dynamic Finance—foundational to building new agility and resilience in Finance that includes touchless, end-to-end processes enabled by automated technologies that leaders can set and forget.

But Lights Out Finance™ isn’t all or nothing.

Imagine a dimmer switch that allows you to turn the lights up and down as needed, but for your finance function instead. At its core, Lights Out Finance™ is about taking the right steps for where your organization is on the corporate finance automation journey.

Our Crunch time report takes an in-depth look at how CFOs can deploy touchless processes and intelligent automation when and where they feel ready, aligned with the organization’s strategic goals and long-term visions for the future.

That’s Lights Out Finance™.

What exactly do you mean by Lights Out?

Lights Out means finance processes that leaders can set and forget like a slow cooker: easy, reliable, and in need of little to no human attention or management. Here’s what we mean:

Data

A standardized data infrastructure, globalized master data and definitions, and a single source of truth enable real-time continuous data, instant insights, end-to-end strategy, and an alignment of actuals and plan.

What Lights Out looks like:

- Standardized data infrastructure

- Globalized master data and definitions

- Single source of truth

Technology

A combination of technologies helps set priorities for innovation and enables emerging technologies. Machine learning enabled decision-making helps free up human workers and enable faster, smarter intelligence.

What Lights Out looks like:

- Dynamic rules-based ingestion, analysis, and processing of routine transactions

- AI augmented, in-transaction, real-time information supporting decision-making

- Humans and machines working together to enable the right action, at the right time

Process

Lean and efficient centrally organized teams oversee standard process design and execution to keep processes streamlined and governed correctly, resulting in higher standardization and improved consistency of processes and inputs. Governance models monitor KPIs, GPOs, and COEs.

What Lights Out looks like:

- Consistent, standardized, and repeatable policies and procedures

- Reduced manual intervention and touchpoints

- Governance models that monitor KPIs and compliance through Global

- Process Owners (GPOs) and Centers of Excellence (COEs)

People

A next-gen tech-savvy workforce provides advanced analytics and insights that drive business outcomes. It’s humans and machines, working together to improve processes and modernize core finance work. What you’ll need: a digital workforce with a focus on analytics instead of just accounting, and skills in problem-solving, communication, listening, and storytelling.

What Lights Out looks like:

- Time to focus on strategic work that adds value

- Emphasis on both technical finance and human skills, like problem solving and communication

- Elevated workforce experience enabled by humans and machines, each doing what they do best

Turn it up, turn it down

Lights Out Finance™ isn’t all or nothing. Imagine a dimmer switch that allows you to turn the lights up and down as needed, but for your finance function instead. Define your vision, name your goals, and then use the dials to create a combination of goals that complement each other.

Remember, it’s the combination factor that provides an end-to-end lens, producing better outcomes and truly dynamizing your function.

When you invest in your foundation, you’re setting the stage for a more flexible, dynamic organization that can handle whatever the future holds—changing business objectives, market forces and disruptions, social unrest and geopolitical change, and more.

Ok, but why?

Because with Lights Out, Finance can truly turn digital, scale up and down based on business demands, reduce costs, and do more, better. Here are a few benefits of Lights Out Finance™:

- Stronger focus on insight generation and analysis of cash flow, balance sheets, profit and loss and more, by leveraging leading-edge technologies such as AI, intelligent automation, and predictive analytics

- A foundation of clean data and data standards that allows business units to operate more cohesively and move faster

- Cost reduction that benefits your talent and technology strategies, as well as the bottom line

- Mitigates your talent challenge by freeing up human workers and their untapped talents

- Digitizes your organization for the long term, while providing opportunities to scale

- Provides better decision support and increased value for Finance in the business, through real-time data and forward-looking analysis

- Focuses on creating efficiencies and streamlining the Finance Operating Model to keep in line with changing and emerging business needs

It’s crunch time

The past few years have shown us just how vital it is for Finance to pivot quickly and react in the moment, whether it’s to a new product, a new process, or a new business unit. Key to that is embracing automated technology that allows Finance to partner with the business in deeper, more strategic ways—without adding resources and costs to the back office.

Lights Out Finance™ is a shift from transactions to outcomes, and from rote processes to insights and analysis that only Finance can provide. Imagine a silo-less function with an integrated ERP, real-time data availability, and next-generation roles and skills for finance workers—and the added ability to help an organization tell the story of its future. With the right playbook and understanding of how to turn the dials, a finance function can achieve all of this.

That’s Lights Out Finance™—and it’s a new horizon for Finance.

Deloitte can help

Our Finance Labs explore the “art of the possible” and define your Finance Transformation strategy, bringing to life potential use cases, road map priorities, and future-state benefits. Contact us to learn more.

Explore other reports and guides in our Crunch time series, along with inspirational Finance Transformation case studies.

Recommendations

Crunch time series for CFOs: The Future of Finance is Dynamic

Transform Finance from function to dynamic capability

Untangling Capital Allocation

How to simplify the challenge